THE TOUR VAN CHECKLIST

You’ve got the tour van all loaded up for that string of club dates, or perhaps that awesome summer festival gig your agent scored. Let’s go through the checklist. Instruments and amps? Check. Food and water? Check. Clean clothes? Check. Gas money? Check. Phone chargers? Check. Insurance? Uh…um…

Yeah, that’s what we thought. While commercial general liability insurance typically doesn’t appear on most bands’ checklist when they hit the road, mitigating risk and being prepared could save you tons of money and headaches down the line. Plus, some events and venues may require your group to have it, so don’t get caught unaware and uneducated.

Bottom line: it’s best to be prepared, and be aware of risk management before you fill up the tank and pull out of the driveway. Some of this stuff might seem like common sense, but common sense has a funny way of taking a backseat sometimes when you put the pedal to the metal.

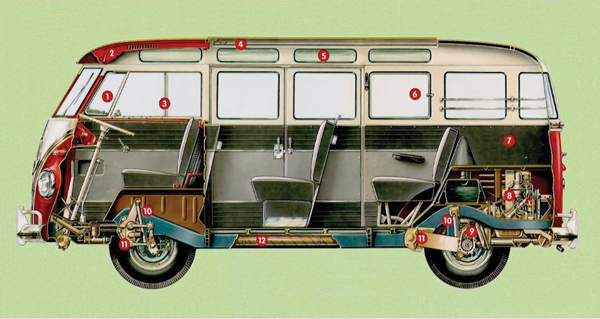

Inside the VW bus

WHAT DOES INSURANCE COVER?

So, what can you do to minimize the risks of being sued? Well, most claims from live performances stem from either bodily injury or property damage, so that’s where we’ll focus. But before we even get there, we spoke with Lorena Hatfield, Marketing Resource Manager for K&K Insurance. And she emphasizes that purchasing liability insurance ahead of the gig “is the best way to protect your band from expensive claims and legal defense costs.” She goes on to explain that, “Liability insurance not only pays damages for which you are held legally liable, it also covers the cost of investigation and defense of claims (even if they are groundless), which can quickly add up to thousands of dollars in legal fees.”

If you’re performing just a one-off show, or multiple dates, choose your coverage wisely. “You may have decided to perform at a local music festival. In this case, the most cost-effective choice would be to purchase a single-event policy designed to provide insurance for the duration of just one event. On the other hand, perhaps you are planning to perform at several different locations over the course of a season. In this case, you may want to look for an annual policy that covers all performances on a yearly basis,” Hatfield explains.

OK, so we know that liability insurance is something your band should be taking into consideration before you go on tour or play those lucrative festival slots. But accidents happen, right? Of course they do, but that doesn’t mean you can’t take a few precautions so that you don’t have to file a claim with your insurance company.

HOW TO MITIGATE RISK ON THE ROAD

1. Be energetic on stage, sure, but don’t take foolish risks.

That means your lead singer should probably not be swinging from the rafters like it’s a 1991 Pearl Jam video, even thought that’s totally rock n roll and badass. Injuries mean dollars, and the venue is probably going to be furious if you hurt yourselves on their stage. You’ll be in for nothing but trouble trying to land future gigs, and don’t be surprised if word travels and other gigs you’ve already booked get cancelled on you.

Hatfield explains, “Some venues mandate minimum limits for performers, so before purchasing coverage be sure to check with the venue for any specific limits or coverage requirements. If there is a performance contract or agreement, it will often contain any insurance requirements. This is an especially important item to note on your contract when booking festival or special event appearances.”

2. Be even more careful with those you invite on stage, and especially crowd interactions.

Worse than hurting yourself is hurting others. So think twice about inviting any non-band members or non-venue personnel on stage during your performance. If they slip and fall because of your negligence and/or your encouragement to stage dive leads to injury, guess who’s going to have the finger of blame pointed at them? That’s not only a terrible blow for you legally and financially, but think of the public image hit you take if you’re associated with contributing to a fan’s injury. No one wants that, so be smart up there. Interact with the crowd, but maybe keep it to a verbal thing, yeah? [To further clarify, K&K states “the general liability policy is to protect [entertainers] from injuries and damage to ‘other people and/or their property.’ Any reference we (Performer) make to injury to the performer wouldn’t be covered by a typical policy. Something to be aware of]

3. Casters, casters, casters!

To put it bluntly, venues don’t like damage. So if you or your road crew has, how shall we say, pre-gamed with a few adult beverages? You might be setting yourself up for a property damage claim. Load in safely (and soberly), and that might mean investing in some casters or dollies for amps, wedge monitors, PA speakers, drums and large cabs that might otherwise be awkward to carry. New York Case Company is our go-to recommendation for high-quality, road-worthy cases that will not only keep your gear intact, but also help your crew load it in without banging up walls, floors and entranceways. Hatfield notes, “If a venue claims you damaged their floor loading in, your liability coverage will cover claims within the limits of the policy.” But let’s not allow it to get to that point, shall we?

amp casters are your new best friend.

4. Keep an eye on your gear.

If you’re playing a show with multiple bands, make sure you or someone associated with your act keeps a good eye on your gear, both while you’re on stage and while you’re off. The last thing you want is a dangerous, loose cable tripping someone up and causing them harm while you play. Or a poorly leaned/stacked amp, speakers or drums tipping over and crushing some poor concertgoer’s foot. Set up your gear safely, store unused gear backstage or securely in your tour vehicle (with someone guarding it while you’re performing), and keep all cables tightly run, coiled and/or out of common footpaths. The venue or festival stage manager should be able and very willing to help with cable management. [Further clarification from our friends at K&K reminds us that “the Liability policy doesn’t cover damage to the entertainer’s stuff…only other people’s stuff that isn’t in their care, custody or control. An important distinction to keep in mind out there.]

5. Duct tape is NOT a miracle cure for electrical issues.

We’ve seen far too many power cables coming off bass and guitar amps that have been MacGyver’ed with all sorts of electrical tape and duct tape to keep the leads intact. You’re just asking for trouble with these quick fixes, especially when you see the wall outlets start smoking in the club (and it’s not just your music that’s on fire). Get electrical issues in your components repaired by reputable technicians. Just because duct tape can hold the cord together for a few more gigs, doesn’t mean it should. Because guess who’s gonna be held liable when the club gets the big bill from their electrician? Yep, you.

All right, enough of the “don’ts” – it’s getting to be a bummer, and that’s not very rock n roll, is it? But you get the point, and hopefully you’ll double-check your new risk management checklist before you hit the open road, and will look more seriously into carrying an insurance policy. Which leads us to…

WHAT SHOULD I LOOK FOR WHEN I’M READY FOR INSURANCE?

We asked Hatfield again, and she recommends this: “When choosing an insurance provider, always ask about the financial stability of the carrier; a high rating (A or better) by an independent rating company such as A.M. Best Company is the safest choice. Also, choosing a carrier that is ‘admitted’ (licensed) is preferable because choosing an insurance company that is non-admitted (called surplus lines) may require you to pay extra fees or taxes.”

She concludes, “Of course, experience is also a factor. Organizations familiar with the unique risks associated with the entertainment industry will be able to accurately price coverage and more importantly, provide prompt and reliable claims handling and resolution services. You may also want to look for convenient services such as the ability to apply and purchase coverage online, as opposed to completing a paper application that must be mailed and approved before coverage is in force.”

So there you have it. What to look for in an insurance provider, and how to avoid claims in the first place by taking a little extra care both on and off stage.

For more information, we recommend visiting www.entertainerinsurance-kk.com

main photo by Karsten Knöfler, used under Creative Commons licenses.